Repo business model

Why repo markets matter

“A well functioning repo market supports liquidity and price discovery in the cash market, thus helping to improve the cost of funding for firms and governments and the efficient allocation of capital.”

BIS, 2017.

“With our wealth of experience in the field, we are well placed to support a financial infrastructure solution for African Sovereign Eurobond debt. A more robust and liquid repo market should lead to more demand from buyers, more refinancing and lower costs of servicing that debt.”

“As a global asset manager, Amundi is proud to support the LSF. This mechanism will foster the emergence and the structuring of the African sovereign debt market, on par with the best international standards. It represents an important milestone for investors, as the African continent offers promising opportunities in terms of sustainable fixed income investment, in particular green bonds.”

Vincent Mortier, CIO, Amundi

Developed countries have long enjoyed the existence of large “repo” markets for their government bonds, facilitating the creation of stable additional funding sources for their public finances.

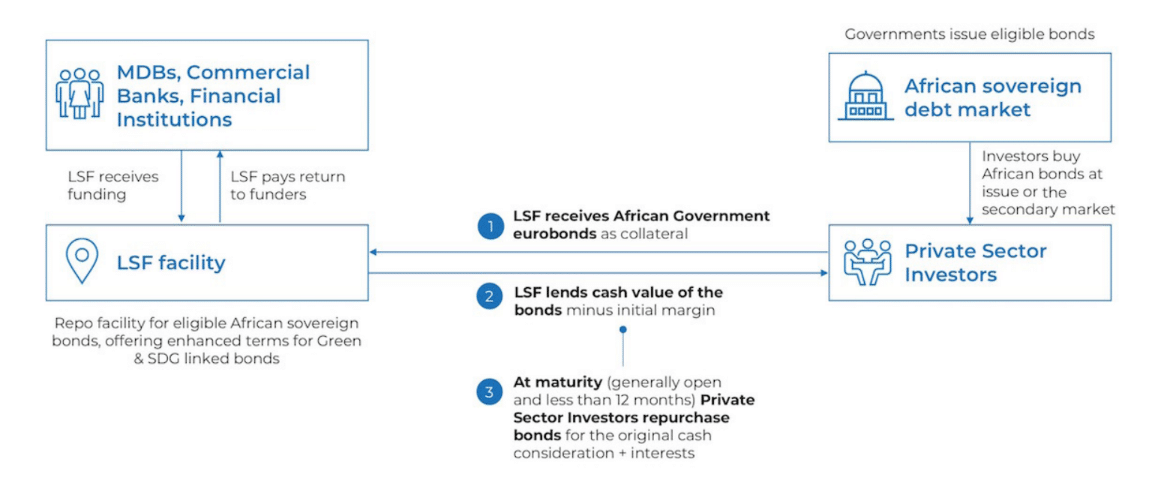

The LSF objective is to kickstart the same dynamic for African sovereign bonds by providing investors with competitive funding through repurchase agreements (“repo”).

The LSF’s mission is to reduce the cost of borrowing by African Sovereigns, increase the pool of private capital willing to invest in Africa and mobilize affordable resources for green investments.

A repo facility dedicated to African Eurobonds, specifically designed to operate at the highest standards of global markets

Key References

| Vera Songwe, Caroline Dawson, Sandra Kendo, Arend Kulenkampff, Sima Kammourieh, Baran Siyahhan and Qing Xu. SSDH, June 2024 Unlocking Private Capital to Emerging Markets & Developing Countries in a time of crisis |

|

| Collegial, LSF LSF, November 2022 Repo Literature Review, Bibliography & FAQ |

Brian A Ruane, BNY Mellon BNY Mellon, 19th May 2022 Why repos are Africa’s next frontier What Repos Can Do for Africa’s Debt Problem |

| Jerome M. Schneider, Pimco Jerry Woytash, Pimco Pimco, 5th August 2021 Fed’s New Repo Facility Should Ease Future Stress, With Caveats |

Hippolyte Fofack, Afreximbank Brookings, October 2021 The ruinous price for Africa of pernicious ‘perception premiums’ – October 2021 |

| Reuters, 28th July 2021 Fed establishes standing repo facilities to support money markets Wolf Street My Thoughts on the Fed’s Back-to-the-Future “Standing Repo Facilities” Announced Today |

Mark Plant, CGD David Escoffier, Eighteen East Capital Center For Global Development, 12th July, 2021 The Case for Liquidity Support for Frontier Markets |

| Sir Jon Cunliffe, Bank of England William C Dudley, President Federal Reserve Bank of New York BIS, CGFS Papers No 59, April 2017 Committee on the Global Financial System: Repo market functioning |

Michael Olabisi, Graziado Business School, Howard Stern, University of Michigan Journal of African Trade, Vol.2 Issue 1-2, December 2015 Sovereign bond issues: Do African countries pay more to borrow? |

| Jens Hilscher, Brandeis University Yves Nosbusch, London School of Economics Review of Finance, Vol.14 Issue 2, April 2010 Determinants of Sovereign Risk: Macroeconomic Fundamentals and the Pricing of Sovereign Debt |

David Lesmond, Tulane University – A.B. Freeman School of Business John Hund, University of Georgia Paper, 17th March 2008 Liquidity and Credit Risk in Emerging Debt Markets |

About The Liquidity and Sustainability Facility

The LSF was designed with the support of the United Nations Economic Commission for Africa and Afreximbank with the dual objective of supporting the liquidity of African Sovereigns Eurobonds and incentivizing SDG-related investments such as SDG and green bonds on the African continent.

The web hosting is powered exclusively by certified renewable energy.